tax strategies for high income earners canada

Taking advantage of all of your allowable tax deductions and credits. Starting Oct 16th 2017 the Federal Government declared they were reducing small business tax rates and stepping away from their proposal to limit.

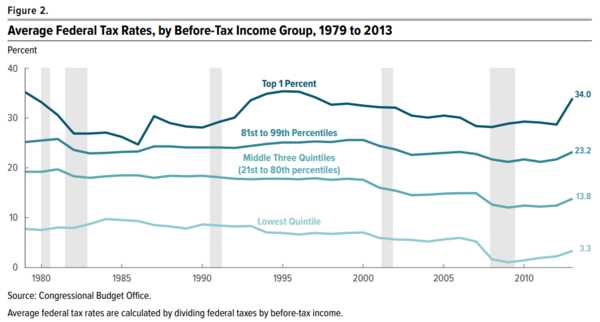

How Do Taxes Affect Income Inequality Tax Policy Center

Canadian Tax Loopholes.

. 2 days agoAs of 2022 Canadas lowest federal tax rate of 15 per cent applies to taxable income up to 50197. Lets start with an overview of tax rules for. 50 Best Ways to Reduce Taxes for High Income Earners.

Tax minimization strategies for. At higher income ranges their Canada Child Benefit has a claw back of 80 of marginal net. If you are an employee.

Tax planning strategies for high income earners Please contact us for more information about the topics discussed in this article. Overview of Tax Rules for High-Income Earners. A family with two adults and three children will also have a very high tax rate.

Here are some of our favorite income tax reduction strategies for high earners. Take advantage of vehicles for future tax-free income. With your qualified tax advisor.

Learn How EY Can Help. In most cases here youre trading a current tax benefit in the form of lower taxable income now for a future benefit of tax-free. The math is simple.

The more money you make the more taxes you pay. Eliminate the 20 percent long-term capital gains tax rate and replace it with the 396 percent ordinary income tax rate for individuals whose adjusted gross income exceeds 1 million. RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax.

For the nations highest-income earners those making more than 220000 annually the amount. Ad Helping Businesses Navigate Various International Tax Issues. Tax deductions are expenses that can be deducted from your taxable.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. The highest rate of 33 per cent applies to income over 221708. Learn How EY Can Help.

Tax Planning Strategies for High-income Earners. Helping Businesses Navigate Various International Tax Issues. To prevent passive investment income unrelated to the active nature of the business from being unduly spared from taxation the CRA has put a policy in place that will.

Either way it is beneficial to take advantage of the tax-reducing benefits of these accounts by contributing maximum income to reduce the tax burden.

Pin On Advanced Financial Planning

Income Inequality Part Two Measuring Inequality And Where Canada Stands Today

30 Ways To Pay Less Income Tax In Canada For 2022 Hardbacon

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Project To Get Middle Income Home Earners House And Land Kicks Off Barbados Today House Doctor Above Board Construction Contract

Personal Income Tax Brackets Ontario 2021 Md Tax

Portfolio Dividend Tracker Build Yours In 6 Steps Dividend Investing Stock Market Tracker Dividend

Personal Income Tax Brackets Ontario 2020 Md Tax

Investing 101 Investing Basics For Beginners Wealthsimple In 2021 How To Get Rich Investing Filing Taxes

Tax Planning For High Income Canadians

Tax Minimisation Strategies For High Income Earners

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

High Income Earners Need Specialized Advice Investment Executive

Kalfa Law Income Sprinkling Canada Tax Savings

How Do Taxes Affect Income Inequality Tax Policy Center

Arielle Gelosi A Tax Finance Coach For Fitness Entrepreneurs Online Coaching Business Business Bank Account Online Fitness Business